Helping Small

Businesses

Succeed

Location

Gurugram, India

Sector

Inclusive Finance (FinTech)

Round Size

$5 Million

Fundraise Stage

Series A

Founding Date

2019

Location

Gurugram, India

Sector

Inclusive Finance (FinTech)

Round Size

$5 Million

Fundraise Stage

Series A

Founding Date

2019

Company Overview

ARTH is an impact led Fintech focused on delivering access to responsible finance for millions of

unserved small businesses in India ARTH has a regulated license to operate as a non-banking

finance company for providing credit. It aims to become the provider of choice in

financial services for the customers, communities, and stakeholders; recognized

for social impact and technology approach.

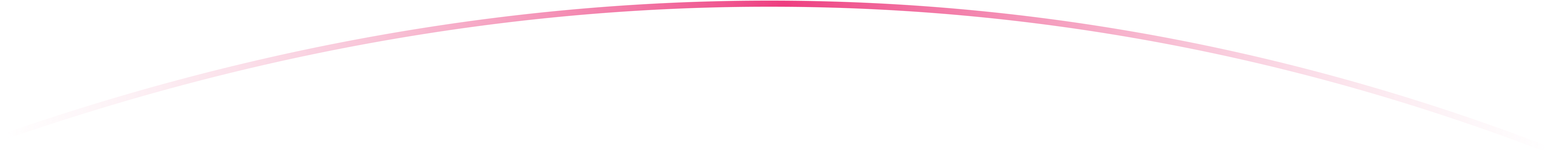

The Challenge

There are estimated to be over 65 Million nano & small businesses (i.e. neighborhood retailers, shopkeepers, saloons, boutiques, merchants) expected to contribute 50% to the Indian GDP in the next 3 years.

Most of these businesses are not under the umbrella of the traditional financial service provider institutes due to low or no credit track record, risk associated with them, lack of education among the target segment to develop and maintain a proper financial record to become a part of the financial sector.

The Innovation

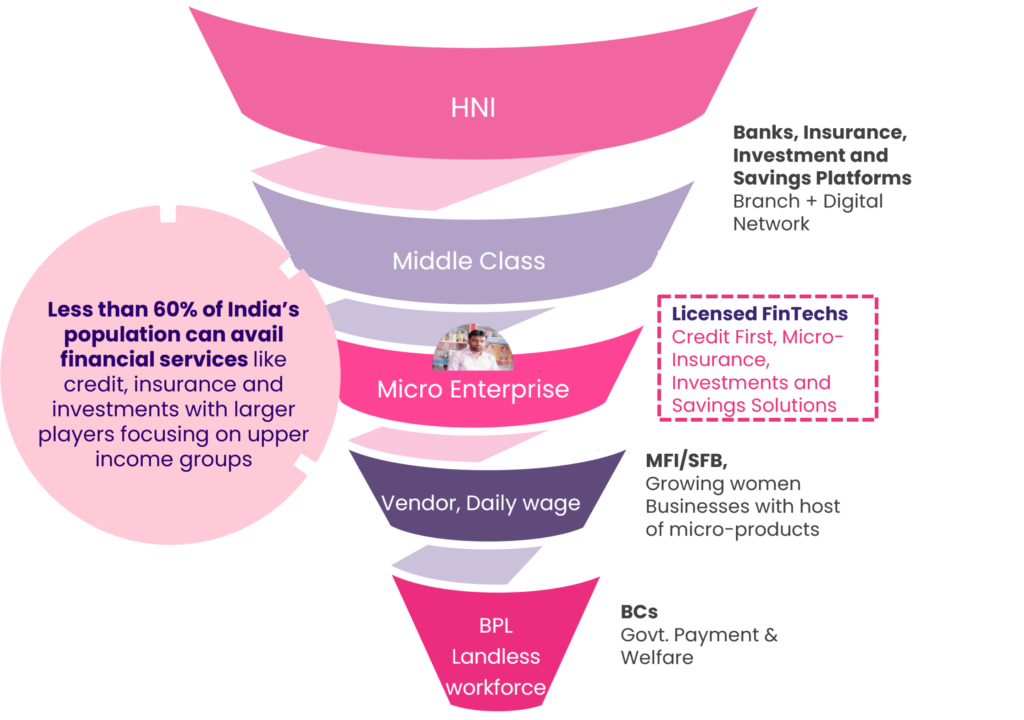

ARTH has built a combination of customer-friendly services, technology solutions and capacity building programs to deliver access to flexible and responsible finance, tackle perceived risk biases and improve financial literacy for local businesses. It’s been a conscious effort to integrate technology with large market data to deliver better outcomes for customers while ensuring optimal human touch in customer service.

With micro-credit solutions as a catalyst, ARTH has a platform has integrated A/C opening, investments, insurance and payments solutions in a low touch, high service model, thereby solving for the financial needs of a small business owner as a one stop solution

ARTH by the

Numbers

ARTH has built a robust distribution and collections model which is low-touch in nature with a focus on efficiency and scaleability.

1 Million+

Customers Impacted

~ $ 3 Million

Credit Disbursement Value

~ 20%

Gross Margin

~ 30%

Repeat Retention Rate

~ 45K

Insurance Offered

Why You Should Invest

Market Opportunity

There are estimated to be over 65 Million nano & small businesses (i.e. neighbourhood retailers, shopkeepers, saloons, boutiques, merchants) in India supporting 200 Million families constituting 1 Billion population; expected to contribute 50% to the Indian GDP meaning thereby, from USD 3 Trillion to USD 5 Trillion economy in the next 3 years.

Tailwinds

The digital India infrastructure has gone through a massive boom in recent years, and the government has an increasing focus on growth of MSMEs for achieving the $5 Tn goal. The new regulatory frameworks also give more clarity and an impetus to players like ARTH to flourish.

Team

ARTH has a strong team of professionals coming from highly reputed institutions with vast years of experience in the fintech space.

Positive Traction

Even with ever-increasing regulatory scrutiny from RBI, ARTH has been able to grow its revenue year on year with strong unit economics. Notably, ARTH has been PAT positive for 3 out of 5 years in operations.

Customer

Acceptability

With a strong retention pool of customers, ARTH has been able to showcase a product-market fit, engaging in multiple financial literacy and education programs to enhance our customer’s capabilities.

Proven Track

Record on Fundraise

With the COVID pandemic in the past, and the market going through a tumultuous time in terms of regulation, the founders have proven their resilience and have been able to raise $2.5Mn from HNIs and family offices already.

Democratising Access to Finance

Empowering the Underserved

Number of SME Workshops Held

FL Training and Micro- Events Conducted

SMEs Benefited

Join us on the journey to create India’s largest

inclusive finance ecosystem!

ARTH is an impact-focused Inclusive MSME Fintech with the objective of providing access to affordable financial services to millions of under-served small businesses in India.

Certifications

ISO 9001:2015 & ISO 27001:2013 (ISMS) Certified

Awards

©2024 Arth

Terms of Use

Privacy Policy